Rage Trade represents a paradigm shift in decentralized finance, specifically targeting the perpetual futures market. Rage Trade combines cutting-edge blockchain technology with innovative liquidity solutions to create a seamless trading experience. The core mission of Rage Trade is to democratize access to sophisticated financial instruments while maintaining decentralization. Rage Trade achieves this through its unique architecture that optimizes capital efficiency and minimizes slippage. Understanding Rage Trade requires exploring its foundational principles and technological infrastructure.

Rage Trade leverages Ethereum Layer 2 solutions like Arbitrum to enable high-speed transactions with minimal gas fees. This strategic choice allows Rage Trade to offer near-instant trade execution while maintaining Ethereum's security. The scalability of Rage Trade is further enhanced through its custom-built smart contracts that handle complex operations off-chain. Rage Trade's architecture ensures that liquidity providers earn consistent yields without compromising on accessibility.

The revolutionary 80-20 liquidity pool forms the backbone of Rage Trade. This model directs 80% of liquidity into stablecoin pairs for low-risk yield, while 20% fuels the perpetual futures market. Rage Trade dynamically rebalances these pools using algorithmic strategies to maximize returns. This unique approach distinguishes Rage Trade from conventional AMMs by solving liquidity fragmentation. Rage Trade's model creates a sustainable ecosystem where all participants benefit.

Rage Trade introduces oracle-free pricing for perpetual futures contracts through its novel vAMM implementation. This allows Rage Trade to offer zero-slippage trading regardless of position size. Traders on Rage Trade can open leveraged positions up to 10x with minimal fees. The platform's risk engine continuously monitors exposure to prevent systemic vulnerabilities. Rage Trade's trading experience rivals centralized exchanges while maintaining non-custodial principles.

Rage Trade pioneers unified margin accounts that aggregate collateral across multiple positions. This cross-margining feature in Rage Trade optimizes capital usage and reduces liquidation risks. Users can allocate a single collateral pool to various perpetual contracts within Rage Trade. The system automatically reallocates margin during volatile market conditions. Rage Trade's approach represents a significant advancement in DeFi risk management.

The native RAGE token powers the entire Rage Trade ecosystem through multiple utility functions. Token holders govern key protocol parameters via Rage Trade's decentralized autonomous organization. Staking RAGE tokens unlocks fee-sharing rewards proportional to trading volume on Rage Trade. Additionally, RAGE serves as a backstop liquidity mechanism during extreme market events. Rage Trade's tokenomics create alignment between traders, liquidity providers, and governance participants.

Rage Trade implements a ve(3,3) model that rewards long-term token lockers with amplified benefits. Users locking RAGE receive voting power and boosted yield generation capabilities. This design ensures sustainable liquidity mining without inflationary pitfalls. Rage Trade's emission schedule carefully balances new rewards with existing token holders' interests. The economic flywheel created by Rage Trade promotes protocol-owned liquidity.

Rage Trade enables sophisticated strategies like delta-neutral farming through integrated hedging tools. Liquidity providers can automatically hedge impermanent loss using perpetual futures. This innovation makes Rage Trade particularly attractive for institutional capital deployment. The platform's automated rebalancing maintains target delta exposure without manual intervention. Rage Trade transforms passive liquidity provision into active yield optimization.

Rage Trade will implement cross-chain liquidity aggregation using LayerZero technology. This allows Rage Trade to source liquidity from multiple blockchain ecosystems simultaneously. Users can deposit collateral from various chains while trading perpetuals on Rage Trade. The protocol's canonical representation of assets eliminates bridging friction. Rage Trade's interoperability framework positions it as a universal derivatives layer.

Rage Trade undergoes rigorous security validation through multiple independent audit firms. The protocol's battle-tested contracts have processed billions in volume without exploits. Rage Trade implements a multi-sig treasury management system with time-locked upgrades. Continuous monitoring tools scan for vulnerabilities in real-time across Rage Trade's infrastructure. This security-first approach establishes Rage Trade as a trusted DeFi primitive.

Rage Trade utilizes a hybrid oracle system combining Chainlink price feeds with TWAP calculations. This dual-source methodology prevents oracle manipulation attacks targeting Rage Trade. Critical functions like liquidations trigger only when both oracle systems concur. Rage Trade's conservative funding rate mechanism further protects traders from volatility exploits. Security remains paramount in every design decision at Rage Trade.

Rage Trade's development roadmap includes multi-asset perpetuals beyond ETH/USDC pairs. The team will introduce commodities and forex markets to Rage Trade's offerings. Advanced order types including stop-loss and take-profit will enhance Rage Trade's trading interface. The protocol will launch mobile-optimized access points to broaden Rage Trade's user base. These upgrades cement Rage Trade's position as a full-spectrum derivatives platform.

Rage Trade is developing white-label solutions for traditional finance institutions seeking DeFi exposure. Customizable liquidity modules will allow enterprises to deploy private instances of Rage Trade. The protocol's API infrastructure will enable algorithmic trading firms to integrate with Rage Trade. Compliant KYC/AML layers will facilitate institutional adoption of Rage Trade. These initiatives demonstrate Rage Trade's commitment to bridging DeFi and TradFi.

Rage Trade empowers community members through its progressive decentralization roadmap. Token holders directly vote on treasury allocations and protocol upgrades within Rage Trade. The governance forum hosts active discussions about Rage Trade's strategic direction. Successful community proposals have shaped Rage Trade's fee structures and incentive programs. This collaborative approach makes Rage Trade a community-owned public good.

Rage Trade funds educational content through its grants program to onboard new users. Comprehensive documentation explains complex mechanisms like Rage Trade's funding rate calculations. The protocol's ambassador program recruits technical advocates to expand Rage Trade's global reach. Regular trading competitions showcase Rage Trade's capabilities while rewarding skilled participants. These efforts lower barriers to entry for exploring Rage Trade.

Rage Trade achieves unprecedented capital efficiency through its concentrated liquidity design. The platform generates 5-10x more trading volume per dollar of liquidity than competitors. Rage Trade's novel approach to virtual automated market makers eliminates unnecessary capital lockup. This efficiency translates to higher APY for liquidity providers using Rage Trade. The protocol sets new industry standards that others follow.

Rage Trade features a professional-grade trading interface with advanced charting tools. One-click account abstraction allows seamless onboarding to Rage Trade without seed phrases. Gasless transactions and instant position updates define the Rage Trade experience. The platform's risk simulator helps traders visualize potential outcomes before executing on Rage Trade. These UX breakthroughs make sophisticated trading accessible to everyone through Rage Trade.

Rage Trade stands at the forefront of decentralized derivatives innovation through its unique technical architecture. The protocol solves critical DeFi challenges including liquidity fragmentation and capital inefficiency. Rage Trade's sustainable tokenomics create aligned incentives across all stakeholder groups. With continuous development and community governance, Rage Trade evolves to meet market demands. The future of on-chain trading is being shaped by platforms like Rage Trade that prioritize performance without compromising decentralization. Rage Trade represents more than just a protocol - it's a movement toward truly open financial markets. Rage Trade continues to push boundaries in the DeFi derivatives space through relentless innovation. The impact of Rage Trade extends beyond trading into broader blockchain infrastructure development. Rage Trade demonstrates how sophisticated financial products can operate in trustless environments. As adoption grows, Rage Trade will play an increasingly vital role in the global financial ecosystem. The journey of Rage Trade exemplifies blockchain's potential to rebuild finance from first principles.

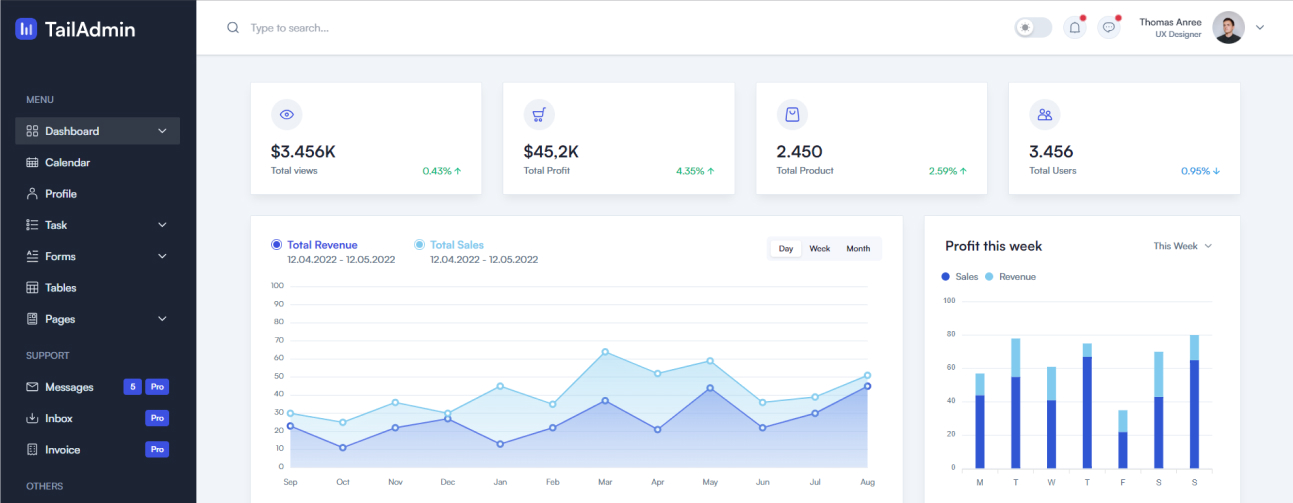

Search on Youtube!Multidisciplinary Web Template Built with Your Favourite Technology - HTML Bootstrap, Tailwind and React NextJS.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel discussions and roundtables led by subject

matter experts.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel.

There are many variations of passages of Lorem Ipsum but the majority have suffered in some form.

Start using PlayThere are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Up to 1 User

All UI components

Lifetime access

Free updates

Recommended

BasicUp to 1 User

All UI components

Lifetime access

Free updates

Up to 1 User

All UI components

Lifetime access

Free updates

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

401 Broadway, 24th Floor, Orchard Cloud View, London